The Rule of 72

Investing for retirement can seem complicated, but it doesn’t need to be. A rule of thumb that helps keep it simple is called The Rule of 72.

All investors want their money to grow. The rate at which your money grows depends on many factors, including how it is invested, what the return is each year, how long you keep it invested, and whether you contribute to or withdraw from the account.

The Rule of 72 demonstrates how many years it will take for your money to double. The shortcut for the Rule of 72 is as follows: if you average a 7.2 percent return each year, your money will double in 10 years. If you average a 10.0 percent return each year, your money will double in 7.2 years.

Applying the Rule of 72

The Rule of 72 is flexible, allowing you to calculate how long it will take your money to double for any average annual return.

72 ÷ average annual rate of return = the number of years it will take for your money to double

72 ÷ 2 percent average annual return = 36 years

72 ÷ 4 percent average annual return = 18 years

72 ÷ 6 percent average annual return = 12 years

72 ÷ 8 percent average annual return = 9 years

72 ÷ 10 percent average annual return = 7.2 years

72 ÷ 12 percent average annual return = 6 years

No one knows how the stock and bond markets will perform in the future, and the Rule of 72 formula requires that you estimate your future return. I recommend you choose your estimate based on your investing style and your past performance. For my financial planning clients (I retired in late 2021 from serving clients), I recommended an estimated average annual return of 7 percent. This was based on a balanced, diversified portfolio with low expenses. When looking at historical performance, some years you will do far better than your estimate (such as 2021) and other years (such as 2022) your investments may lose money. The key is to average—over 10 years or so—your estimate.

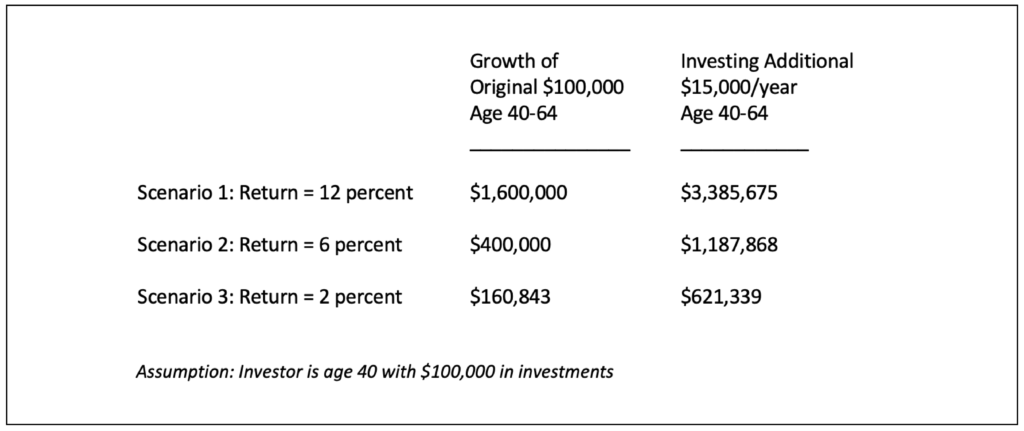

Let’s look at three different scenarios. One assumes a 12 percent average annual return, which is quite rosy. One is more conservative, assuming a 6 percent average annual return. The third scenario is ultra conservative, assuming a 2 percent average annual return.

The assumptions I used for the calculations below are that your investment accounts contain $100,000 now, and you are age 40. The Rule of 72 works for any amount, so you simply adjust the starting figure to reflect the current value of your investments.

- With a 12 percent average annual future return (see above chart), your investments will double every six years. Therefore, at age 46, your $100,000 will have grown to $200,000. At age 52, it will be $400,000; at age 58, it will be $800,000; and at age 64, it will be $1.6 million.

- If we assume an average annual future return of 6 percent, your investments will double every 12 years. Your current $100,000 investment account at age 40 would become $200,000 at age 52, and $400,000 at age 64.

- Lastly, let’s look at an average annual return of only 2 percent. This may be realistic for someone who keeps most of their money in a bank, because banks typically pay depositors less than 1 percent. With an assumption of 2 percent for future average annual returns, the $100,000 starting value will double in 36 years. Therefore, it would take our 40-year-old until age 76 to double the amount to $200,000. At age 64 the $100,000 would have grown to $160,843.

The Rule of 72 + Consistent Investing

Your average annual future return determines how quickly your money will grow, and managing your investments wisely in an effort to maximize your future return deserves your attention. The Rule of 72 demonstrates the power of compounding.

Combining the Rule of 72 with consistent saving and investing makes your money grow even faster. Let’s assume you are contributing to your 401(k) every year through your employer. If you are age 40, the maximum you can contribute for 2023 is $22,500. However, let’s assume contributing that much is not feasible for your family’s cash flow needs, but you can contribute $1,250 per month, or $15,000 per year. If you have a Roth 401(k) or 403(b) available, I strongly recommend you contribute to it, rather than to a traditional 401(k) or 403(b). (Most investors will benefit more from the long-term tax-free growth and tax-free withdrawals of the Roth 401(k) than the tax deduction (in the year of the contribution) of the traditional 401(k)). Your monthly savings can also be invested in a Roth IRA or in a taxable brokerage account. Make your monthly investments automatic.

The diagram shows the impact of combining the Rule of 72 with saving $15,000 per year ($1,250 per month) between the age of 40 and 64. Averaging an annual return of 12 percent (as in Scenario 1) may seem too optimistic, but averaging a 6 percent return (Scenario 2) is very reasonable.

Scenario 2 is based on a 40-year-old investor with $100,000, who invests $15,000 per year from age 40-64, and who averages an annual return of 6 percent. The result is a retirement portfolio of almost $1.2 million at age 64—almost triple the $400,000 figure from the Rule of 72 alone.

Use an online savings calculator, such as the one at www.bankrate.com, to customize the projections. Input the total of your current investment accounts, and the amount you plan to invest each year, and it will estimate the future value when you expect to retire.

Small changes—such as increasing your annual investments when possible—or investing tax refunds or bonuses—will help your investments grow more rapidly. Wise investing and financial security do not require “shooting for the stars” with risky investments. Slow and steady wins the race!

Thanks for reading! To receive my monthly email with my latest article — and excerpts from my upcoming book Sage Choices After 50 — please sign up here. Connect with me on Medium and read past articles here.

Donna Skeels Cygan, CFP®, MBA, is the author of The Joy of Financial Security. She owned a fee-only financial planning firm for over 20 years and is now writing a new book, Sage Choices After 50, that will be published in 2023.