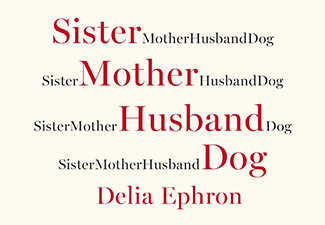

Delia Ephron and Me

https://donnaskeelscygan.com/wp-content/uploads/2014/03/blog-23.jpg

325

225

Donna Skeels Cygan

https://secure.gravatar.com/avatar/ef134acf060902e6362b779bec98ed53?s=96&d=mm&r=g

While writing my book, The Joy of Financial Security (published November 2013; available on Amazon and in bookstores nationwide), I had to fight to keep personal stories in the book. A few stories were from my childhood and others were from my financial planning clients. Some editors and reviewers envisioned the book as a financial [...]read more