We all try to raise kids to become hard working, happy and financially responsible adults.

That’s a tall order!

First, we need to realize that every child has their own personality, and we cannot totally shape or control the way our children will end up. Yet there are many ways to teach our kids money skills that will serve them well as adults. These tips are also for grandparents – often kids are more eager to listen to their grandparents than their own parents.

Communicate!

Every tip for teaching kids about money comes down to communicating. Money is a topic that has been swept under the rug for many generations. This needs to stop. Talking with your kids or grandkids about money is one of the best things you can do. Here are some conversation starters:

Throughout your life have you found dealing with money easy or hard? Why?

What mistakes have you made in your life regarding money?

What successes have you had regarding money?

What did your parents or grandparents teach you about money? We call these “money messages” we received as children. An example may be “Money doesn’t grow on trees” or “We never had enough money to get to the end of the month” or “Save for a rainy day” or “Our parents lived through the Great Depression and they told us stories about …”

It’s important to start the conversation, even if it feels a bit like preaching. When it comes to money, opinionated comments are justified; for example, telling a child or grandchild that they should never buy anything they cannot afford, or that carrying credit card debt from month-to-month is a dangerous habit, or that many people living in expensive houses are striving to pay their bills each month because they are living beyond their means, are all key. Share positive and negative money stories with them, because they need to know that everyone makes mistakes. They also need to understand that many people are far less fortunate and helping others is a generous thing to do.

Experiences to teach kids about money

In addition to talking about money, you can provide experiences to give your children and grandchildren real-world examples.

When you go to a restaurant, let your child or grandchild pay the bill (using your money). Use cash rather than a credit card. Help them count out the cash and calculate the tip – without a cellphone calculator. Calculate how much your family would have saved on that meal if you had not ordered sodas or other drinks, and you drank water instead. Calculate what the savings may add up to over a year.

Once the pandemic is over, take your child or grandchild to a bank. Once they are a teenager, they can have a checking account, and many banks provide special services for teenagers and college students. Show them how to write out a check and fill in a check registry. They may also choose an online service like Quicken or Mint to help them manage their finances.

Play games like Scrabble. This will teach your child or grandchild spelling and vocabulary, but it will also help them with counting the score.

If they are interested, explain the definition of a stock and bond, a mutual fund, a CD (certificate of deposit), a mortgage and a credit score. If you know what these are, use your own definition. If you need help, find more information on the internet. Do the research with your child or grandchild, and you will be learning together.

Strategies based on age

Consider these strategies based on the age of your child or grandchild.

Ages 3-9: Children can start understanding the concept of money at a very young age. Give them an allowance of $3 per week (or whatever amount you choose). Set up three mason jars, with one labeled Saving, one Spending, and one Charity. Have your child divide the $3 by placing $1 in each jar. You can explain that the saving jar is to save for a special item in the future, the money in the spending jar is to use any time for something they would like, and the charity money is to give to someone in need. Starting with an allowance of $3 per week for a child aged 3 or 4 is appropriate. As they get older, raise it to $5, $10 or more as you choose.

Ages 10-17: This is the age when kids feel peer pressure to have nice clothes or the latest technology gadget. Talk with your kids about values. Teach them that family and friends are far more important than money. If they need new jeans or sneakers, help them look for discounts. Once the pandemic is over, go to a vintage clothing store with them, and find some treasures. They are establishing their identity at this age, but that does not need to include designer clothing. Let them make mistakes. If they buy expensive sneakers, let them realize they would still have money remaining if they had chosen a high-quality, but less expensive brand. Talk with them about the costs of in-state and out-of-state colleges, as well as public vs. private colleges. Talk about what your family can afford. Explore college loans with them.

Ages 18-29: Help your child or grandchild establish a budget. Parents or grandparents can learn new financial skills at any age. If you have not set up saving to be automatic for yourself, set this up now (through a taxable account or Roth IRA at a brokerage firm, or a bank account). Help your child or grandchild set up automatic savings accounts, too.

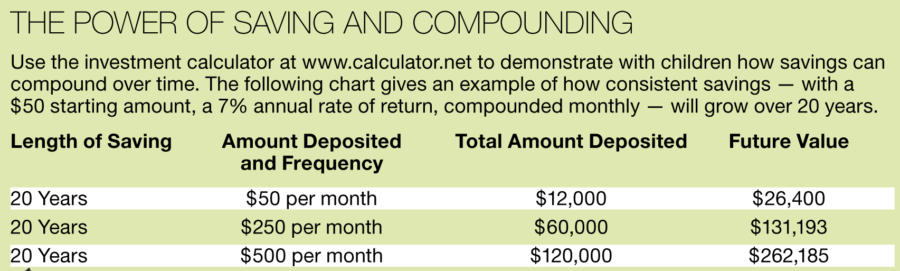

Discuss the saving examples in the box. These exercises teach the concept of compounding, which is a powerful financial tool. Play with the calculators at www.calculator.net for educational loans, mortgages and car loans.

If your child goes to college, work with them on a monthly budget for their spending money. Talk with them about credit cards, filing taxes, and maintaining a high credit score.

Start talking with your child or grandchild about finances. It will enrich your relationship, and your child will benefit from your wisdom about money.